Middle East remains aviation battleground for Russia and US

Control over sales in the Middle East could be exceptionally lucrative, with customers having sizeable defence budgets and lacking domestic defence aviation industries. GlobalData associate defence analyst Madeline Wild investigates.

The Dubai Air Show highlighted ongoing commercial competition between Russia and the US for Middle Eastern customers. Control over sales to the region could be exceptionally lucrative, with Middle Eastern customers having sizeable defence budgets and lacking domestic defence aviation industries.

Competition between the US and Russia over the UAE’s future fighter jet contract was a point of focus at the Air Show. The US are hopeful that the Lockheed Martin F-35 Lightning II will be chosen to fulfil the UAE’s requirement over the Sukhoi Su-75 Checkmate being offered by Russia.

President Biden has approved the sale of the F-35 after previously having been put on hold, the sale would form part of a larger US$23 billion package of defence equipment for the UAE. The US has been keen to highlight the potential benefits for the UAE of having the F-35 including potential interoperability with F-35 fleets in nearby Europe.

The initial agreement to sell the UAE F-35’s led to the Emirati’s recognising Israel and establishing diplomatic relations which was a significant step towards regional cooperation. However, the Russian’s feel equally confident that the Su-75 Checkmate can offer the UAE enough to win a lucrative contract.

Future fighter jet negotiations

Rostec, the parent organisation of Sukhoi, has held talks with UAE to discuss co-production of the Su-75 if it were to be purchased by Emirati Armed Forces. This would be economically beneficial for the UAE, with any domestic production of the jet providing a boost to the UAE’s indigenous defence industry.

It is worth noting that China also exhibited their L-15 trainer jet and associated weaponry to attract potential customers to Chinese defence technology. Russia and the US should remain cognisant of China’s future potential to be a third major supplier to the Middle Eastern defence market.

However, China is currently struggling to find foreign buyers for some of its aircraft; notably its fighter jets. Currently in development is the FC-31 that aims to rival the F-35. However, until that enters service, the JF-17 is the primary Chinese export fighter.

The JF-17 is being jointly developed with Pakistan and has only been sold to Myanmar, Nigeria and Pakistan. Following the limited success of exporting the JF-17, China has refused to export the J-20 (China’s answer to the F-22) to protect the technology.

Other aircraft sold by China, including the Y-8 transport aircraft and the K-8 trainer aircraft, have had more success internationally and thus may explain the decision to exhibit the L-15 trainer at the Dubai Air Show rather than a fighter variant; the Middle Eastern market is already highly competitive and so it is understandable to show an aircraft type that has had success historically.

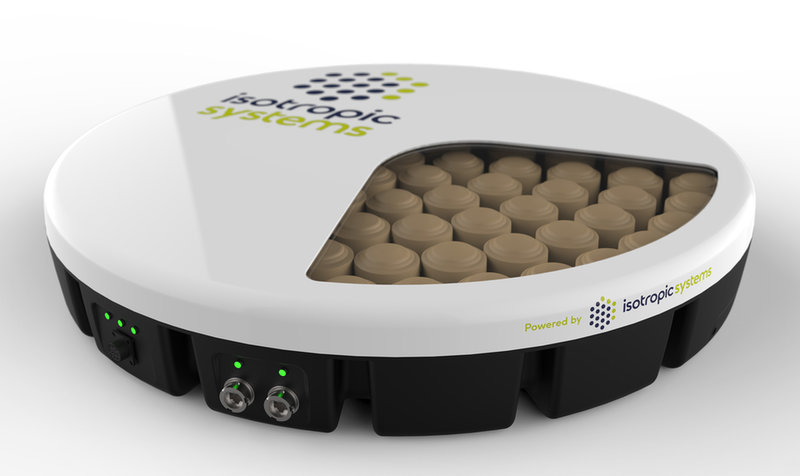

// Isotropic Systems’ multi-beam terminal meshes signals from multiple satellites

The more of these satellite systems that go up, the more it creates the demand for an antenna that can connect to more than one at a time without compromising performance.

Global Britain

Several factors have facilitated the uptick in US acquisition of UK companies in the defence sector as well as in other industries. Firstly, the price of the stock has been relatively cheap this year owing to Covid-19 and post-Brexit financial struggles and secondly, current government policies have encouraged foreign investment into the UK.

The slogan ‘Global Britain’ represents the idea being pushed by Boris Johnson's government that the UK is ‘open for business’. Subsequently, investment into the UK, be it through merger and acquisition (M&A) practices or other means, is being actively encouraged, at the expense of UK-owned industry.

This is at odds with the UK’s European neighbours, where having partial ownership by the state is common. Large European defence companies such as Thales, Hensoldt and Nammo all have some form of state ownership.

The recent flurry of M&A activity in the defence industry has been subject to investigation thanks to the NSI Act, demonstrating the fine line the government walks between upholding their neoliberal FDI principles, whilst appeasing its voters who would rather promote British-owned business first.

// Main image: Competition between the US and Russia over the UAE’s Future fighter jet contract was a point of focus at the Air Show. Credit: Joe Ravi / Shutterstock.com

Aircraft