No easy options in Australia’s quest for nuclear submarines

Australia has a deadline of 2036 for the acquisition of new nuclear submarines and while its quest is far from over, its ambition to assemble them in South Australia has significant roadblocks and is heavily reliant on an influx of foreign manufacturers and personnel. By GlobalData Analysts.

Comments by the head of Australia’s nuclear submarine task force indicate that Australia is selecting a 'mature design' with production already in existence, which limits it to a few key candidates. A possible option for Australia is a submarine based on the Virginia Class attack submarine operated by the US.

However, this has a number of potential problems. Primarily, that Electric Boat and Newport News, the American shipyards that currently construct the submarines, are only just fulfilling current orders and are focused on preparations to build new Columbia class submarines, leaving them little room to either expand domestic production or export production capability to Australia.

In the UK the Astute class presents a potential option for the Australians, the Astute is smaller and less expensive to produce than other options including the Virginia Class, but UK shipyards are similarly congested with production and would likely not be able to accommodate the increased production required by Australia. Additionally, the UK is phasing out the nuclear reactor that is fitted in the Astute - compounding the problems with selecting this model.

Senate hearing

A combination of several of the above could be an option, but this presents its own problems. In an Australian Senate hearing at the end of October, the idea was floated that the rear half of the submarines, containing the nuclear reactor could be built overseas and the remaining 40% built domestically.

But this would encounter the problems with foreign production listed above as well as personnel and production issues on the Australian side. Estimates of full domestic production put the cost at 1.5 to two times the price of producing the submarines wholly overseas, in addition to the extra time in setting up a total or even partially Australian production line. These create a significant barrier to the idea of domestic production.

The main barrier is cost, since building the facilities and transporting all the necessary equipment to Australia will significantly increase the costs of an already expensive purchase. Australia has a deadline of 2036 for the acquisition of new submarines when the first of its diesel-powered Collins-class submarines will outlive its already extended lifespan.

The ramp-up for this programme will have to start sooner rather than later. Australia is at present, a nuclear-free country and only has one university programme dedicated to nuclear engineering, producing five graduates a year. Even with a ramp-up they will not be able to produce enough personnel domestically and will have to rely heavily on foreign recruitment.

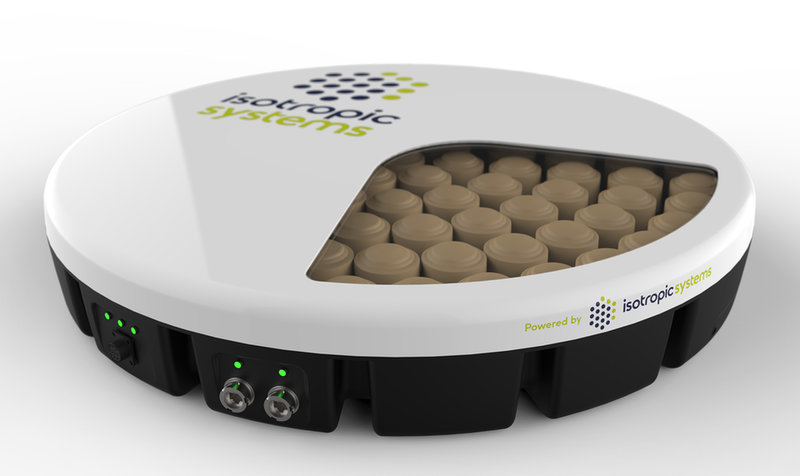

// Isotropic Systems’ multi-beam terminal meshes signals from multiple satellites

The more of these satellite systems that go up, the more it creates the demand for an antenna that can connect to more than one at a time without compromising performance.

Global Britain

Several factors have facilitated the uptick in US acquisition of UK companies in the defence sector as well as in other industries. Firstly, the price of the stock has been relatively cheap this year owing to Covid-19 and post-Brexit financial struggles and secondly, current government policies have encouraged foreign investment into the UK.

The slogan ‘Global Britain’ represents the idea being pushed by Boris Johnson's government that the UK is ‘open for business’. Subsequently, investment into the UK, be it through merger and acquisition (M&A) practices or other means, is being actively encouraged, at the expense of UK-owned industry.

This is at odds with the UK’s European neighbours, where having partial ownership by the state is common. Large European defence companies such as Thales, Hensoldt and Nammo all have some form of state ownership.

The recent flurry of M&A activity in the defence industry has been subject to investigation thanks to the NSI Act, demonstrating the fine line the government walks between upholding their neoliberal FDI principles, whilst appeasing its voters who would rather promote British-owned business first.

// Main image: Lead ship of its class, USS Virginia, underway. Credit: US Navy photo by General Dynamics Electric Boat.

Submarines