Ukraine conflict briefing

Powered by

Download GlobalData’s Ukraine conflict executive report

- ECONOMIC IMPACT -

Latest update: 6 October

0.3%

Economic activity in Europe and Central Asia will remain deeply depressed through next year, with minimal growth of 0.3% expected in 2023.

35%

Ukraine’s economy is projected to contract by 35% in 2022 as a result of Russia’s invasion with calls for a modern-day Marshall Plan for Kyiv growing.

The World Bank has dimmed prospects of a post-pandemic economic recovery for emerging and developing countries in Europe and Central Asia, as the Ukraine war continues. However, the region has weathered Russia’s invasion of Ukraine better than previously forecast, with output expected to contract by 0.2% this year.

World Bank figures predict Ukraine’s economy will contract by 35% this year following destruction to production capacity, damage to agricultural land, and reduced labour forces with more than 14 million people displaced as a result of Russia invasion. Reconstruction estimates total at least $349bn, which is more than 1.5 times the size of Ukraine’s pre-war economy in 2021.

- UKRAINE CRISIS OVERVIEW -

Latest update: 6 October

$530 million

The World Bank announced another round of funding to help Ukraine meet needs created by Russia’s invasion.

15%

The percentage of Ukraine illegally annexed by Russia followed discredit referenda in the occupied regions of Luhansk, Donetsk, Zaporizhzhia and Kherson.

Adding the latest round, announced on 30 September, total World Bank-mobilised support now stands at $13bn. The commitment was made possible due to loan guarantees by the UK ($500m) and Denmark ($30m) under the Public Expenditures for Administrative Capacity Endurance in Ukraine project, which supports continued government capacity, including the provision of core public services such as health, education, and social protection.

More than 100,000km2 of Ukraine’s territory was claimed by Russian President Vladimir Putin to be part of the Russian Federation following September referenda by people in the occupied regions of Luhansk, Donetsk, Zaporizhzhia and Kherson. The referenda were widely discredited by the international community, while Ukraine vowed to retake its lost lands. A counterattack by Ukraine in the days that followed liberated significant amounts of territory.

- IMPACT ON COMMODITY MARKETS -

Latest update: 24 March

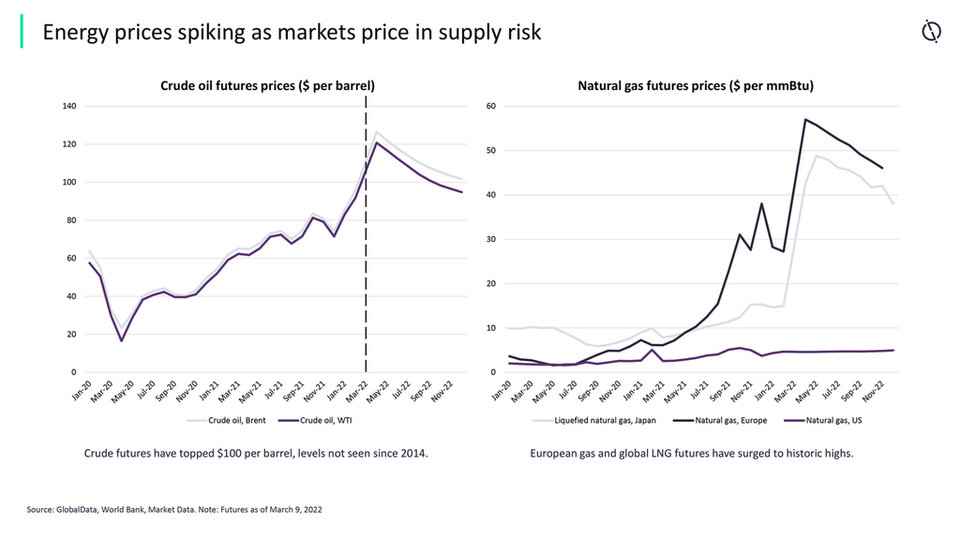

Energy prices spike as markets price in supply risk

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Latest update: 6 October

Supply chain and demand disruption

Although relatively small economies by global standards, Ukraine and Russia are substantial exporters of platinum, aluminium, titanium, nickel, cobalt, lithium, neon, xenon and palladium used in civil and military aerospace and defence electronics.

Defence OEMs continue to speak of the difficulties experienced in the global supply chain, with the Ukraine war exacerbating the fallout from the Covid-19 pandemic. However, donations of equipment by NATO states to Ukraine is expected to create opportunity for international defence companies.

Impact of sanctions

The Russian economy has been hit hard by international sanctions, although it has attempted to limit exposure through increased trade with China and India. World Bank projections forecast Russia’s GDP will drop 11% in 2022, the largest dip since the collapse of the Soviet Union.

Moscow has invested heavily in developing military systems for new markets, such as the Middle East, which could now turn their attention to China or western countries. Dependent existing importers of Russian hardware, such as India, stand to be impacted by more stringent application of US CAATSA regulations, likely impacting the S-400 SAM and stealth frigate procurements.

However, high oil prices and Russia’s leverage of its status as an energy exporter have negated some of the financial fallout.

A report by Ukrainian thinktank StateWatch also claimed that 24 Russian arms manufacturers involved in the production of Kalibr cruise missiles and other weapon are not under any sanctions in the UK, EU, or the US.

Industry predictions

While NATO member governments have been quick to speak of the need to boost defence spending to counter to threat of Russia, pressing national priorities and economic issues have impacted the ability for countries to immediately increase spending.

Companies are monitoring the situation and working with customers to ensure that production is able to meet demand, particularly high in areas such as ammunitions and tactical weapon systems.

Celeste Wallander, US Assistant Secretary of Defense for International Security Affairs at the Department of Defense, reiterated calls that the NATO target of a national 2% spend on GDP on defence was “a floor, not a ceiling”.

European countries have broadly committed to increasing defence expenditure, with the most recent analysis by GlobalData showing that France’s military spending is forecast to grow from $50.3bn in 2022 up to $68.0bn by 2027. Financial allocations for acquisitions amounted to 24% of the total budget in 2018, whereas they are expected to account for 33% by 2027.

The applications of Finland and Sweden to join NATO are being ratified by the member states. However, Turkey and Hungary are yet to agree, with Ankara in particular looking to extract significant concessions before any approval.