Feature

Steel on the sea: Latin America’s maritime shift

The need for maritime patrol vessels in Latin America provides a lucrative market for European and Asian suppliers, although an acquisition shift could be coming. Helen Haxell‑White reports.

Argentine navy OPVs in 2024. Credit: Jacinto Escaray / Shutterstock

For Brazil, Colombia, Argentina, Chile, and surrounding nations, littoral operations by OPVs and corvettes are more crucial than ever, with their respective navies leveraging these vessels to survey shores and shield maritime zones and citizens from adversaries, particularly organised crime.

Versatility is paramount, with scarce hull numbers and extensive EEZs to monitor, as crews are tasked to perform demanding constabulary roles to armament operations.

European and Asian manufacturers act within the region as predominant suppliers of OPVs and corvettes, with examples including the French Naval Group’s new Gowind-class corvettes in Argentina to the former South Korean Pohang-class corvette, now ARC Almirante Tono in Colombia.

However, moving forward, some countries in Latin America are keen to develop indigenous warship manufacturing capabilities.

Dr Vinicius Mariano de Carvalho, SFHEA, reader in Brazilian and Latin American Studies, at King's College London, noted it was important to consider that some countries in the region have a clear industrial strategy of reinforcing or reinvigorating their own naval construction sector, like Brazil, Chile, Peru, and Colombia.

“This factor will probably have more impact in their procurement strategies than the environment of operations,” explained Mariano de Carvalho.

EEZ a primary focus for Brazil

OPVs play a vital role for maritime security amidst regional challenges on the water. While mixed procurement is common, Brazil's reported move towards building 11 domestic vessels hints at a future where indigenous shipbuilding could become the standard in Latin America, contingent on defence budget growth.

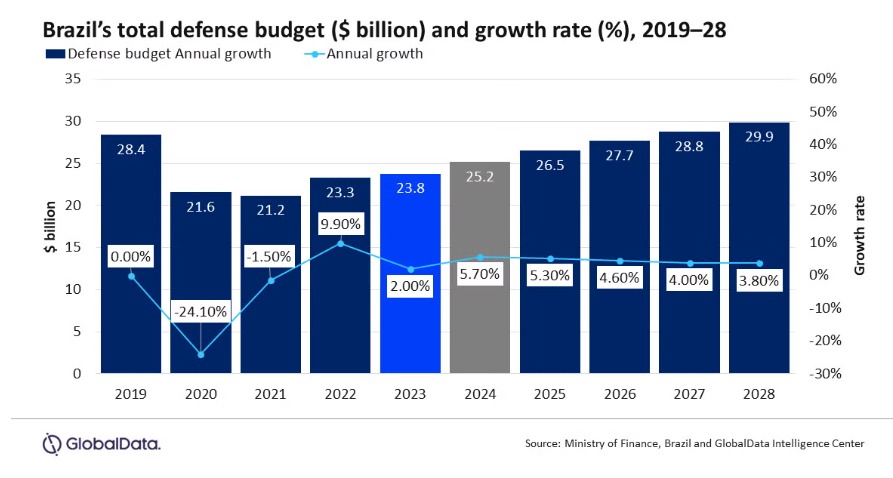

These particular vessels would add to the current fleet of more than 20 OPVs in Brasilia’s armada. Regarding funding, in accordance with GlobalData, the next three years will see a rise in Brasilia’s defence budget’s annual growth, increasing from $26.5bn in 2025 to $29.9bn this money will likely support this investment.

As part of the current fleet, British manufacturer BAE Systems not only delivered three Offshore Patrol Vessels (P120 Amazonas, P121 Apa, and P122 Araguari) and related support but also provided Brazil with a manufacturing license for future vessels of the same class.

Source: GlobalData

The company completed deliveries in 2013 of the Amazonas-class OPVs for the Brazilian Navy, its modular design enables adaptability to support further armament to the existing main gun and two 25mm guns.

Dr Carlos Solar, senior research fellow Latin American Security, Royal United Services Institute (RUSI), told Global Defence Technlogy: “Brazil is pushing its patrol vessels acquisition programme with a focus on protecting its EEZ [exclusive economic zone], SAR [search and rescue], and illegal operations including drug trafficking towards the Gulf of Guinea where the challenges include piracy and non-state armed actors.”

Colombia sees value in corvettes

The situation is not too dissimilar in the Northwest of the region, according to the US International Trade Association, Colombia has a budget of approximately $10.4bn, which is around 10% of the total Colombian budget for 2023 of $101bn.

Bogota’s navy operates the Pohang-class corvette ARC Almirante Tono, which was incorporated into its naval fleet in 2020, having preciously served for years in the Republic of Korea Navy.

Solar said Colombia operates from its Cartagena de Indias base and has become the primary contributor to maritime security in the Caribbean.

“These particular OPVs not only provide strategic deterrence capabilities towards a hot border with Venezuela, but also reconnaissance and surveillance tech needed for intelligence gathering against transnational crime organisations in Colombia’s territorial sea and wider operations that Colombia exercises with partners, including the United States, in the busy Caribbean waters,” Solar explained.

Bogota’s corvettes are utilised for practical, tactical, and operational use. Credit: Colombian Navy

To boost Colombia's shipbuilding further, COTECMAR, the state-owned ship builder, is in the midst of a three ‘Ocean Patrol Vessel’ programme for the Colombian Navy. The 93-metre-long vessel features spaces for a fast boat and helicopter, with the first steel cut taking place in Q1 2023.

The Colombian Dirección de Operaciones Navales confirmed to Global Defence Technlogy how the Pohang-class corvettes have undertaken a significant role in the progression of Colombia’s naval operations to personnel development.

“With the capabilities of anti-submarine, anti-aircraft, anti-surface warfare, as well as control and surveillance of coastlines, island and maritime spaces, they [the corvettes] have been the setting for the sailors, men and women who crew this type of units to increase their training and qualifications,” a Operaciones Navales spokesperson commented.

The vessels have also been utilised for the country’s maritime development, international exercises, which have, in turn, “demonstrated the tactical and operational use in benefit of the Colombians in the protection of the blue of the flag,” the Operaciones Navales confirmed.

Regional round up

In the south of Latin America, Argentina grapples with economic instability indicated by rising inflation and the continued commitment to a fixed two-year budget by President Javier Milei. This has constrained defence spending, with GlobalData forecasting in 2024 that the country’s defence expenditure would register a compound annual growth rate of just 0.1%, to reach $1.9bn in 2029.

In April 2022, the French defence contractor Naval Group, which was unavailable for comment to this piece, supplied the last of four Bouchard (OPV 87) class multi mission vessels to add to the Argentine Navy’s fleet. The 87m vessel is capable of 20kts and can support a helicopter alongside 59 crew.

With Milei’s commitment to bolstering the Argentine military whilst operating austere policies, close ties with the US could influence future procurement decisions when it comes to upgrades across the defence forces of Buenos Aires.

Chile is among Latin American operators of OPVs. Credit: juan68 / Shutterstock

On the Pacific Coast, Chile is eyeing a major naval overhaul, with plans encompassing a renewal of its OPV fleet and shipbuilding expansion, with particular reference to the OPV-80 class which Santiago aims to update.

The Chilean Navy's current capabilities include six 80m Cabo Odger (OPV 84) vessels, each with a helicopter landing spot and accommodation for 60 personnel. Looking ahead, GlobalData forecasts that Chile's defence budget, which stood at $1.84bn in 2024, will grow at a CAGR of over 1%, potentially influencing future naval acquisitions.

On external influences in the procuring of OPVs and corvettes in Latin America, Solar noted: “Europe-based companies have long been involved in designing and developing OPVs for the Latin American market and run with a certain prestige that is hard to defeat given historic strategic alignment and already integrated procurement processes.”

Furthermore, Mariano de Carvalho stated that Latin American countries were searching for partners for their industrial and procurement requirements and aiming for less dependency in terms of fleet support and maintenance as well as enabling national companies to provide sub systems and parts.

“Strategic alignment is playing a less important role than a pragmatic approach related to technology transfer [and] offset,” Mariano de Carvalho said.

OPVs and corvettes represent a pragmatic and potent solution for Latin America to safeguard its maritime domains against escalating threats. Although established practices favour a mix of imports and domestic builds, the future could see indigenous capabilities dominate regional naval procurement if budgetary limitations ease.

The UK Space Command continued, stating the UK Ministry of Defence (MoD) has procured commercial data from geostationary orbit to support the protection and defence of SKYNET - the MoD’s satellite communication capability. In March 2025, it was announced that the first of the SKYNET 6 assets, 6A, had completed the initial phase of testing at the National Satellite Test Facility in Oxfordshire.

The satellite will utilise digital processing and radio frequency spectrum utilisation and is expected to be launched in 2026.

UK tech company Spaceflux was tasked in Q4 2023 to build a new ground-based space camera-telescope system known as Project ‘Nyx Alpha’, which will monitor objects in geostationary orbit approximately 36,000km above the Earth’s equator from Cyprus. Alongside the development of ‘Nyx Beta’ are UK electro-optical sensor projects which will enable data sharing with allies.

We can't afford to have sovereignty everywhere

UK Air & Space Commander Air Marshal Allan Marshall

Caption. Credit:

Phillip Day. Credit: Scotgold Resources

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.