Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 30 March

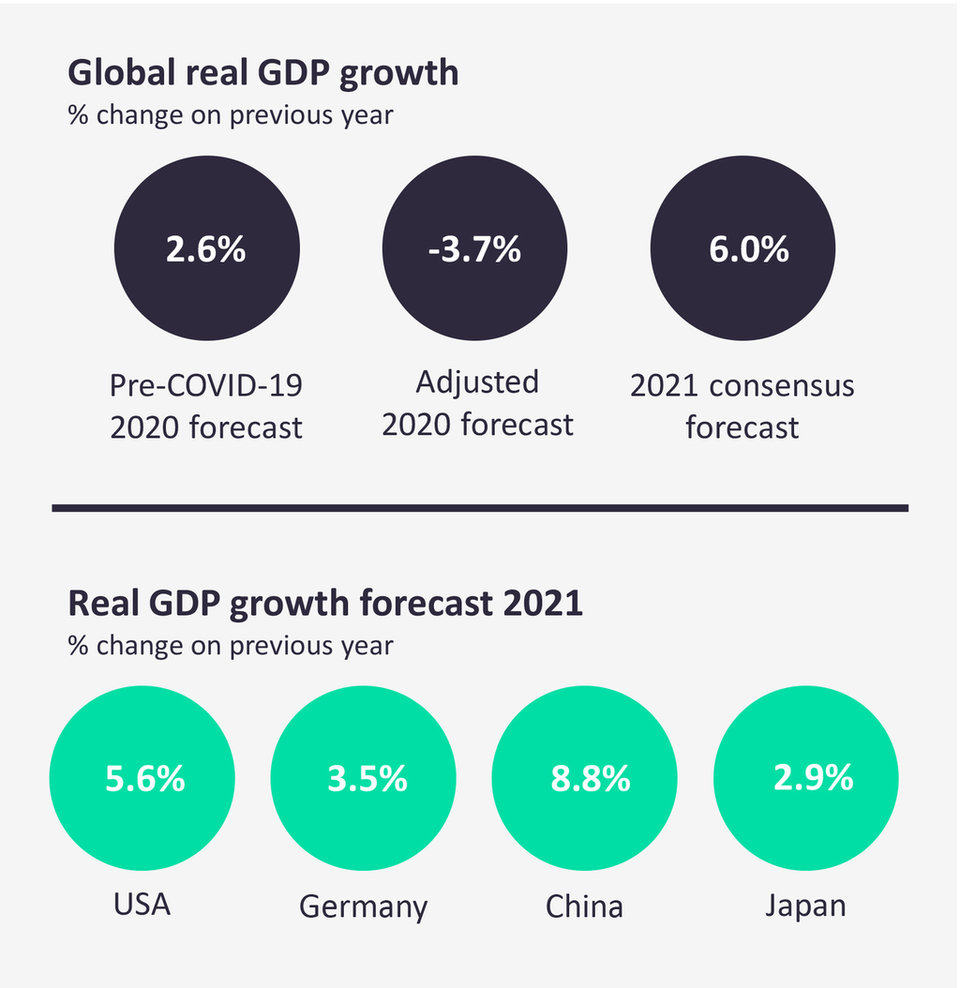

After months of decline, GDP estimates for many countries have turned positive, but unemployment remains high around the world.

According to UNCTAD, global trade declined by 9% in 2020 with a 6% contraction in goods trade and a 16.5% contraction in services trade.

6%

Consensus forecast for real GDP growth in 2021 globally

8.8%

Foreast for China's real GDP growth in 2021, 3.2% higher than the US

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

- The road to economic recovery -

The global economy is forecast to return to pre-crisis levels by the end of 2021 or early 2022.

The global economy is projected to grow at record speed in 2021, but the outlook is uncertain and will depend on the effectiveness and distribution of the vaccines and on continued fiscal and monetary support. Recovery will be uneven across countries, sectors, and income levels.

China was the only major economy to achieve positive GDP growth in 2020. Covid-19 related exports led the economic recovery. In 2021, China is expected to account for 27% of global economic growth - more than twice as much as the US.

- SECTOR IMPACT: Aerospace, defence and security -

Latest update: 8 April

Defence markets, although relatively shielded from both immediate demand and supply side shocks, are now starting to look vulnerable in many parts of the world as national debates are ignited around fiscal priorities.

Western supply chain concerns stemming from Chinese-US rivalry have been exacerbated by Covid-19. This will result in greater FDI scrutiny, multisourcing and onshoring in key product areas such as microelectronics.

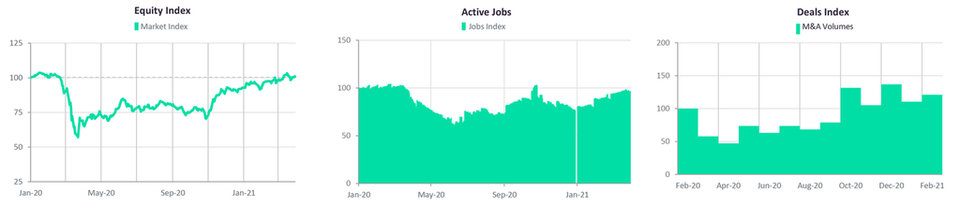

Sector indices

The interdependent relationship between aerospace and defence has helped to cushion the impact of Covid-19 on companies working across both segments. Targeted government aid will be instrumental to recovery in these sectors.

Sub-sector impact

Revenue predictions

Credit: L3Harris